Automotive industry under pressure - Top 10 questions that automotive suppliers (should) ask

13/03/2024

The situation in the European automotive industry is challenging. Difficult economic times meet the industry transformation. In particular, suppliers are facing important decisions in order to shape their business for success. We take a look at possible fields of action and the most urgent questions in the market, as we at Schlegel und Partner are currently experiencing them.

It is no secret that the automotive industry - especially in Europe and Germany - is currently facing tremendous challenges.It feels like almost every second trade article describes the problematic effects of global geopolitical conflicts, vulnerable supply chains and increasing competitive pressure as the automotive transformation moves towards electrification, digitalization and decarbonization.The European car manufacturers have got off relatively lightly so far. Until the end of last year, EBIT figures were largely stable at an average of around 12 to 13 percent - with double-digit sales growth compared to the previous year 2022.The current slowdown in demand and increasing price pressure – mainly from Tesla and the highly competitive Chinese market - are reducing the OEM's flexibility for planned investments in the electric powertrain including power electronics and battery as well as in E/E architecture and software. In addition, measures to reduce CO2 emissions and establish product and material cycles must be pushed forward.The ecosystem is changing and the traditional linear way of doing business is increasingly becoming a phenomenon of the past. Established OEMs must think and act more in networks and partnerships, especially with regard to connectivity and software-defined vehicles - the basis for autonomous driving and data-based value-added services along the entire vehicle life cycle.

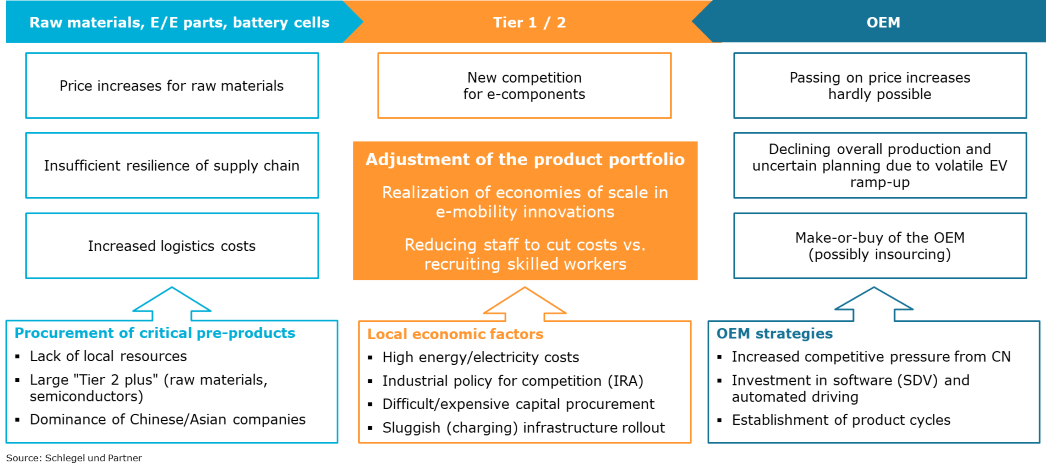

Suppliers hit particularly hardFor traditional automotive suppliers, the sandwich position between OEMs and the pre-chain with the large raw material and component suppliers is becoming even more uncomfortable due to the OEMs' current cost-cutting measures. Last year, many large tiers already had EBIT margins of between two and six percent. Smaller (Tier 2) suppliers and those with a particularly high need for transformation even struggled with operating losses. The current weakness in the already volatile demand for e-components, coupled with further price pressure from OEMs, is causing suppliers' sales expectations to fall. Consequently, many are cutting costs, for example by relocating production and laying off employees, as the prominent examples of ZF, Bosch, Forvia and Continental show. Further consolidation in the industry is foreseeable in the coming years.

Figure: Challenges faced by the European supplier industry

Suppliers want solutions they can implement quicklyFor a successful future, suppliers must accelerate change processes even further - with the appropriate know-how, personnel and financial resources. Innovative new business and more profitable existing business often have to be rebalanced in order to remain viable in a competitive environment. Key management task is to continue the profitable existing business to the satisfaction of the customer while allocating the internal resources in a way that enables new (often not yet profitable) strategic fields of business to be successfully rolled out.In addition to typical strategic issues relating to technology, value proposition and target market, Schlegel und Partner's clients are now increasingly looking for solutions with a short to medium-term impact. Solutions that can be implemented as quickly as possible are currently in demand.Shortened, agile and focused development processes and the digitalization of production can help to reduce costs. In addition, there are several fields of action that suppliers can address.

Figure: Fields of action for automotive suppliers

Opportunities and requirements vary depending on the company's individual background. However, it seems essential to focus on core competencies that enable competitive products or services with high added value. Given the often diverse range of innovation topics, each with unclear monetization and/or profitability, it is crucial to prioritize topics with high market opportunities and good profitability prospects.The basis for this is an understanding of the target market - i.e. existing and potential customers (or "customers' customers"). In China in particular, the largest vehicle market in the world with a lot of potential for suppliers, the rules of the game are often different. However, new business relationships in this market must also be seen in the context of imminent market consolidation, which will cause some OEMs to disappear from the landscape.

Diversification of target markets can also be a viable option, as long as other (growth) markets outside the automotive sector can be conquered using existing expertise. The prerequisite is market knowledge and acceptance that automotive processes and volumes cannot simply be transferred.The outlined fields of action for automotive suppliers give rise to a number of typical questions that Schlegel und Partner deals with on a daily basis.Following is a subjective selection of the top 10 most critical questions:1. How can I secure my existing profitable business for as long as possible? How do my customers see demand developing in the short to medium term? Where do I need to improve in order to remain competitive? 2. What options do I have to compensate for foreseeable underutilization of my existing facilities?3. How can I meet the requirements for CO2 footprint and recyclability with my products? 4. Which of my innovations offer the best market opportunities? Where and with whom? 5. Which potential customers have a concrete interest? Who should I approach and how?6. What value proposition do I need in order to be successful in new markets or with new customers?7. What conditions do I need to be prepared for when doing business in China, the USA or India? What opportunities and risks do I need to consider?8. Which new suppliers will help me to establish a resilient procurement structure and meet CO2 requirements for the supply chain?9. Who would be potential investors or buyers for my "non-core business"? Which acquisition candidates are there to increase my added value or offer USPs in my strategic business areas? 10. Which target markets outside the automotive sector make sense for me? What do I need to be successful there? Who do I need to address where and how?

Which topics are at the top of your agenda?

We look forward to every professional exchange... always with the aim of taking you a step forward on the path to transformation.

Further information:

Sebastian Lüttig, Telefon +49 6201 9915 67,

Sebastian.Luettig@SchlegelundPartner.de© Schlegel und Partner 2024